Among the troubles that New York Community Bank (NYCB) has been facing over the past two weeks, an online storm of fake profiles might look like the least of the bank’s problems.

But when troubles are already brewing, they can easily be amplified and boosted by fake profiles, and the impact on an already trending crisis could be substantial.

TL;DR?

- During its crucial weeks of financial crisis, 18% of the profiles discussing NYCB on X (Twitter) were fake.

- The fake profiles started posting on the same day the crisis was mentioned in the media.

- Overall, 34% of the posts about NYCB were created by fake profiles.

- The bots were actually promoting the bank’s stock and suggesting now is the time to invest. Why? Read to find out.

Why Do Bots Thrive in Financial Crises?

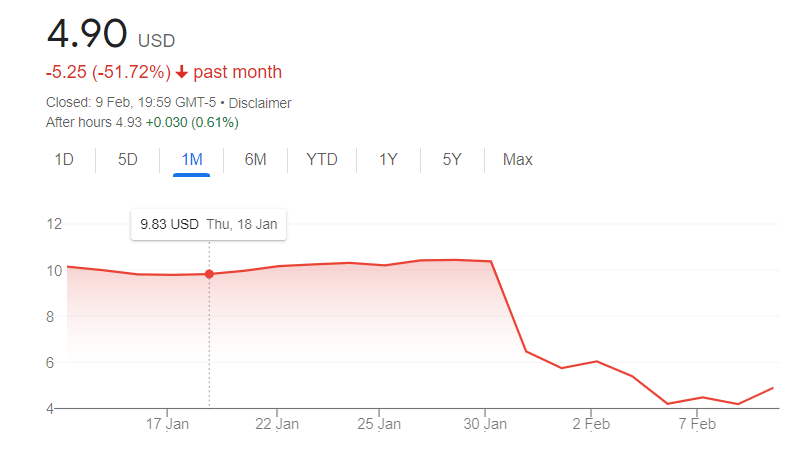

NYCB is one of the largest banks in the US, with 395 branches across the country. Like many other banks, it was not immune to the current financial crisis. 2023 has seen the fall of both First Republic Bank and Silicon Valley Bank, and it seems the crisis has now reached larger financial institutions. The bank’s stock started plummeting after rating agencies Fitch and Moody’s lowered NYCB’s ratings, and major new channels expressed concern for the bank’s future.

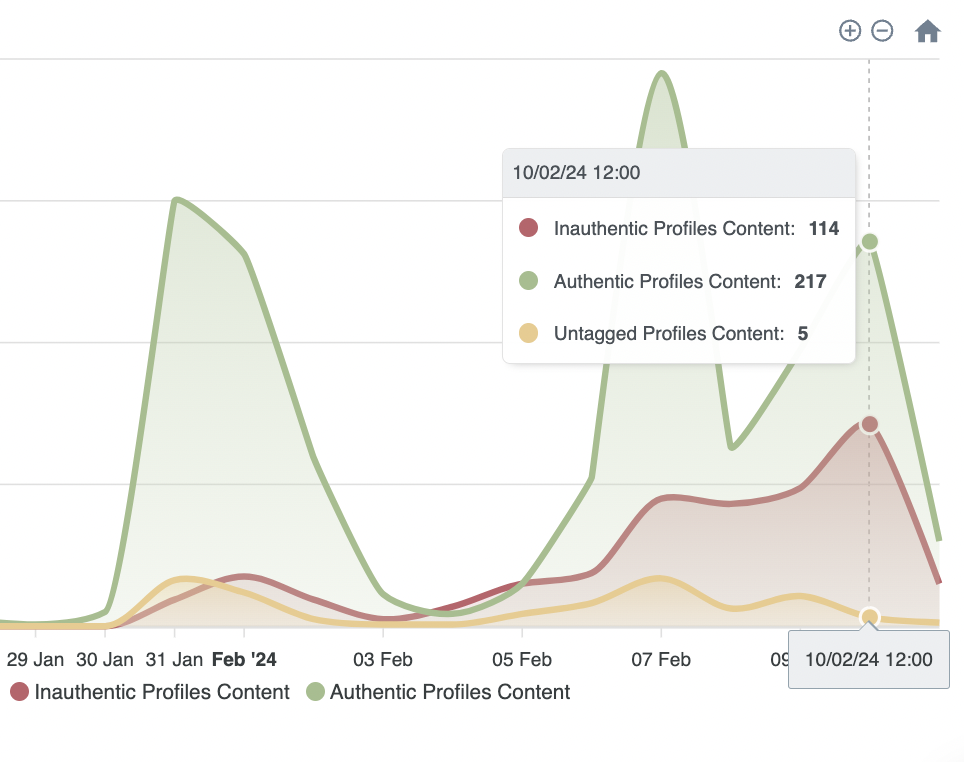

Cyabra identified a notable number of fake profiles in conversations about NYCB: 18% of the profiles discussing the bank on X were fake. The inauthentic accounts were mostly bots, and started posting on January 31, the very same day NYCB’s stock started decreasing. Their part in the conversation kept growing over time, up until February 10, a day when many major news channels reported NYCB’s crisis: on this day, the fake profiles were responsible for over 34% of the discussions surrounding the bank – hundreds of posts, which reached the eyes of hundreds of thousands of people.

Surprisingly, the fake profiles were actually trying to promote the bank’s stock. If this was an authentic discourse, it could have been part of a “bottom fishing / buying the dip” strategy: investors buying a stock while prices are dropping in the hope of profiting when it rises again, or even a “junk bond” investment. Obviously, the bots didn’t make their intention clear: they simply promoted the purchase of the stock, claiming it was recommended by top analysts and that it would rise next week, and sharing links to a Discourse channel which upon further investigation appeared not to support the original advice of investing in NYCB’s stock.

However, the bot network wasn’t very sophisticated: the profile pictures looked artificial (possibly purchased en masse rather than created by a modern GenAI engine), their handles and account names appeared to be manufactured in bulks, and they all repeated the same message. Most of them were created at the end of December, when rumors of the bank’s upcoming crisis were already spreading.

Despite the fact that this fake campaign was somewhat primitive, it nevertheless managed to cause harm to the bank’s reputation. The bots caused NYCB stock to trend, and by doing that actually helped spread the news of the bank’s crisis. Furthermore, advertising NYCB stock when it was clearly plummeting appeared not only questionable but downright deceitful, causing potential investors to waver.

Asking the Right Questions

While analysts, bankers, and stock brokers would argue that NYCB itself would never use the cheap tactic of fake campaign promoting its stock in the hope of saving it – and they would, of course, be right – this is where the wider public’s knowledge is found lacking. Reading posts promoting the purchase of a stock that is clearly plummeting instigates a red flag, and undermines the reputation of NYCB irrefutably.

However, the important question is not who created this fake campaign and why. It’s what the impact on the public is and what damage the bots can and will cause. While it’s more likely that this strategy was employed by a competitor aiming to create an impression of NYCB appearing desperate, the outcome is that despite the purported intention of boosting the bank’s stock, the fake campaign ended up severely damaging NYCB’s reputation. In times of financial crisis, banks are particularly vulnerable on social media. FRB’s and SVB’s executives actually admitted that social media played a significant role in the collapse of their banks. This is why banks have to be aware of their online reputation, and be alerted to any change in related discourse, especially one that is being pushed by bots or other fake profiles.

Learn more about defending banks during times of financial crisis by contacting Cyabra.

Read more: