How Fake Networks Amplified the JPMorgan MicroStrategy Boycott

Cyabra's analysis details how JPMorgan’s institutional warnings regarding MicroStrategy’s Bitcoin exposure were weaponized by a coordinated network to incite a widespread bank boycott

Cyabra’s analysis shows how JPMorgan’s institutional research on MicroStrategy’s Bitcoin exposure was rapidly reframed online into a hostile reputational narrative.

Following the publication of the note, MicroStrategy’s share price declined by approximately 40% within several weeks, coinciding with intensified criticism of JPMorgan across social platforms.

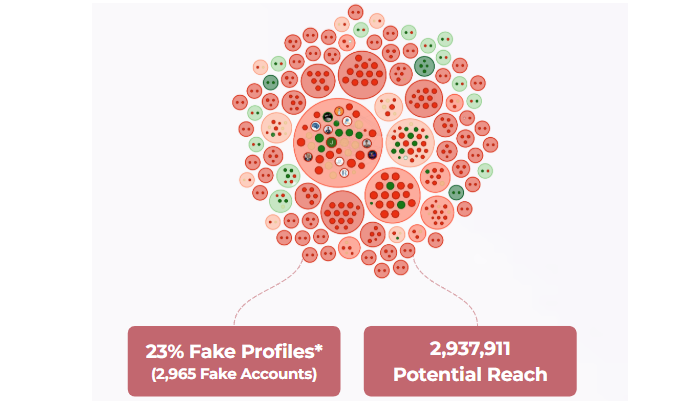

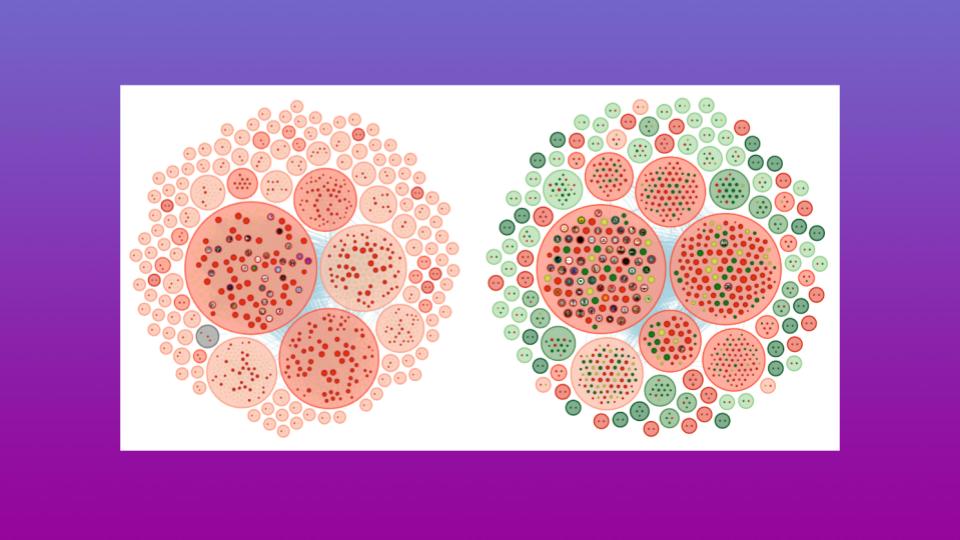

Cyabra found that 23% of the accounts driving the negative discourse were inauthentic – nearly three times the industry benchmark – generating an estimated potential reach of almost 3 million users.

The synchronized spikes between fake-profile activity and negative sentiment indicate coordinated amplification that escalated boycott calls and significantly increased reputational risk for the bank.

#Brand Reputation, financial, Stocks

Fill up the form below and receive the full report directly to your inbox

Related reports

DeepSeek AI: Coordinated Fake Campaign

February 9, 2025

Cyabra uncovered a network of fake profiles promoting the hype around DeepSeek AI.

Moscow Terror Attack

March 28, 2024

Cyabra categorizing profiles based on their authenticity and grouped them into communities by connections and shared behaviors.

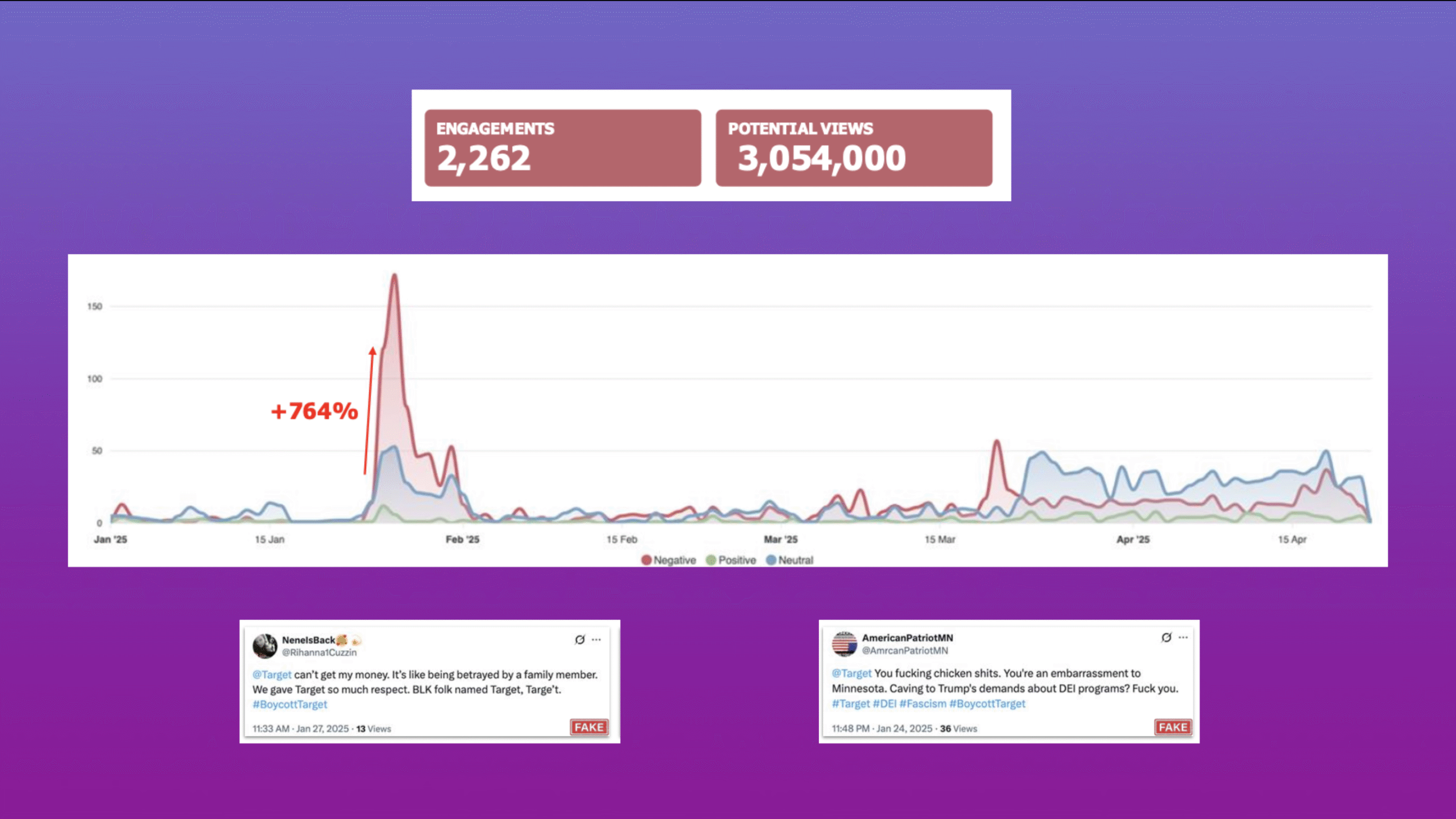

Targets DEI Decision and The Inauthentic Backlash

May 5, 2025

Following Target's decision to scale back its DEI initiatives, Cyabra exposed a wave of inauthentic activity fueling outrage and economic threats.