The finance world has been subjected to various fraud and abuse threats on social media. Those threats can cause financial loss, damage to reputation, and legal consequences. If you work in any large financial institution – banks, credit companies, or investment funds, here are three major concerns you should be aware of, threatening the finance sector.

1. Social Engineering Attacks

social engineering techniques are used to manipulate people into taking actions that are harmful to themselves or their organization. For example, an attacker might pose as a customer service representative and ask for the victim’s personal information in order to “verify” their account.

Attackers can use social media platforms to create fake profiles, gather personal information, and send phishing messages to employees, customers, or partners of your financial institution. Social media can also be used to distribute malicious software (malware), such as viruses, worms, and Trojan horses. Once the malware is installed on a victim’s computer, it can be used to steal data, damage files, or take control of the computer.

Social media provide cybercriminals with a vast pool of personal information about individuals, making it easier for them to conduct social engineering attacks and scams. These threats pose a significant challenge to financial institutions, as they can lead to the loss of customer data, financial losses, and reputational damage.

It is important to remember that social media platforms themselves can also be hacked, leading to the theft of passwords, email addresses, and credit card numbers, which in turn enables fraudsters to commit identity theft and other crimes.

The global cost of cybercrime in 2022 was $8.44 trillion, and is expected to surge to $23.84 trillion by 2027 (statista.com).

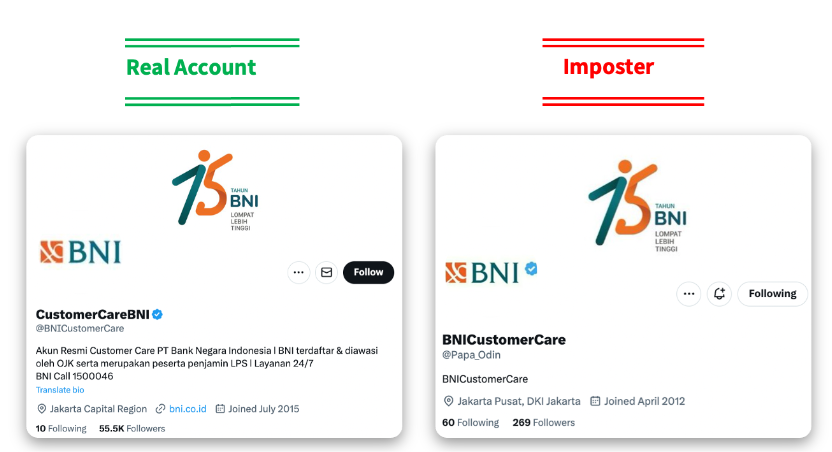

2. Brand Impersonation

In 2022, the Federal Trade Commission (FTC) received over 2.4 million reports of fraud and identity theft, with total losses of over $8.8 billion (an increase of more than 30 percent over the previous year).

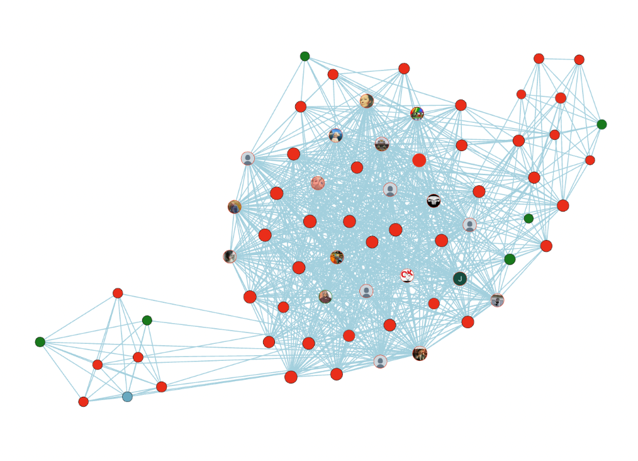

Fake social media profiles can easily look like they belong to legitimate businesses or individuals. Social media platforms can be used to impersonate your brand and deceive customers. Cybercriminals can create fake accounts that mimic your brand, use your logos, and post fraudulent messages to trick customers into disclosing personal information or making fraudulent transactions. Brand impersonation can lead to significant financial losses, damage to brand reputation, and legal consequences.

3. Fake News and Market Manipulation

Social media platforms can be used to spread false information about financial institutions, causing market instability and damaging reputation. We have witnessed this happening with the collapse of SVB and the way it affected FRB and other banks.

Cybercriminals can use social media to disseminate fake news about an institution’s financial performance, management, or products, leading to market manipulation and loss of shareholder confidence.

Fake news and market manipulation can cause significant financial losses and regulatory consequences.

Like and Share for a Chance to Lose Your Money!

When it comes to cybersecurity strategy, it’s important to understand that even if you’re aware of all said threats and addressing them on a daily basis with your CiSO, you’re only aware of them at this very moment. Looking at the future, financial institutions must consider that the threat landscape is constantly evolving. Cybercriminals are constantly developing new ways to exploit social media platforms. It is important to stay up-to-date on the latest threats and to implement new security measures as needed. It’s also important to remember that no single security measure is enough: a comprehensive security strategy should include a variety of measures.

How to Protect Banks And Financial Institutions From Online Threats

It takes more than just awareness and education to protect your company or organization. A comprehensive social media security strategy is needed to address these challenges. There are a number of things that financial institutions can do to protect themselves from future threats emerging on social media:

- Monitoring social media for threats: using social media monitoring tools, financial institutions will be able to identify and respond to threats quickly, as well as identifying fake news and market manipulation. Some social monitoring platforms also provide capabilities for mitigating against fake accounts and preventing impersonations.

- Educating employees about online dangers: employees should be aware of the risks of social media and the importance of protecting their personal and company information.

- Educating and protecting customers:

- educating customers about the risks of fraud and abuse on social media is just as important as educating employees: if you provide them with services or products, make sure they know how to spot scams and protect their personal information, and won’t fall prey to malicious actors impersonating your company.

- Make it easy for customers to report fraud. Provide a secure way for customers to report fraud, and make sure that they are promptly notified of any fraudulent activity on their accounts.

- If possible, offer additional services of fraud protection to your customers. This could include things like fraud alerts, credit monitoring, or identity theft insurance.

- Implementing strong security measures: strong passwords, two-factor authentication, and firewalls.

In conclusion, social media-related fraud and abuse pose significant risks to financial institutions, in the US and worldwide. These threats require a proactive and comprehensive approach to mitigate the risks and protect your business from financial loss, reputational damage, and legal consequences. By implementing a social media security strategy that includes monitoring, remediating and training, you can reduce the risks and protect your customers and business.

Want to know more about protecting financial institutions from social media threats? Contact Cyabra!