In March 2023, First Republic Bank started trending, and not in a good way.

In the banking sector, reputation is everything. Any financial expert (or any Mary Poppins fan) will tell you that even the largest, most stable, most reliable bank is only as good as the trust its clients currently have in it.

The collapse of Silicon Valley Bank last March due to global economic instability marked the beginning of the snowball: the American people were starting to lose confidence in their banking system. Concerns about the banking sector have spread globally, raising fears of a crisis. First Republic Bank (FRB), was the next bank to trend negatively on social.

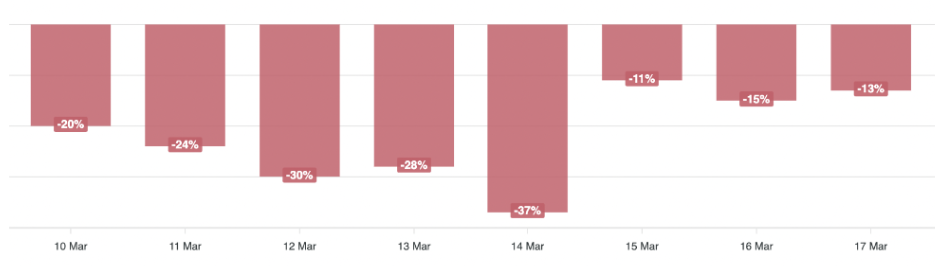

Cyabra discovered that FRB’s sentiment dropped by 165% in the week following the collapse of SVB (see graph below).

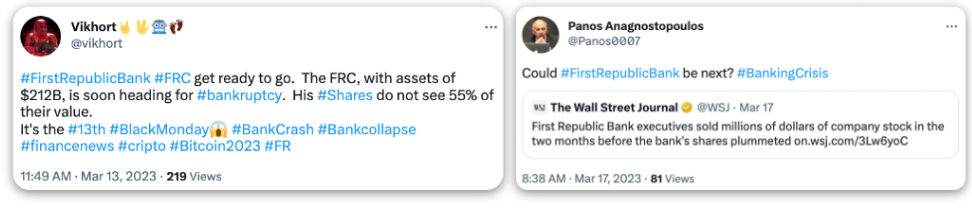

Two trending hashtags, #Bankcollapse and #Bankingcrisis, were used frequently in this negative discourse. Authentic profiles with a reliable background in finances were warning about FRB being the next bank to collapse, reporting about bank customers withdrawing their savings, and generally promoting feelings of fear and distress.

From there, the road downhill was clear. Rating agencies Fitch and S&P declared low confidence in the bank’s financial strength, which affected stocks further.

My Money Don’t Jiggle Jiggle – it Trends

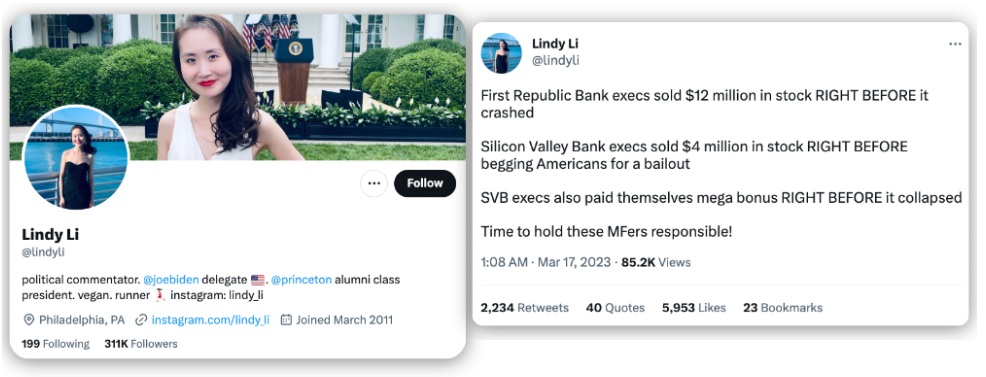

Cyabra uncovered the most influential profile in the discourse: Lindi Li, a political commentator (previously the youngest female congressional candidate in U.S. history) whose tweets called out the banks for corruption, criticizing SVB’s and FRB’s executives for taking advantage of their prior knowledge of the banks’ problems and selling their stocks.

Lindi Li’s own reputation, as well as her active Twitter persona, helped her tweet to go viral: it reached over 8,000 engagements and the eyes of over 85,000 profiles, causing major reputation damage to FRB.

Tweeting the Money Away

Reputation damage is usually linked in our collective mind with bots, sock puppets, and other fake profiles actively trying to harm companies, brands, and industries.

But this time, the crisis was amplified by authentic, active profiles, some with a well-earned reputation on social networks. Furthermore, we can carefully assume most of those Twitter profiles weren’t participating in the discourse with the intent to cause harm to FRB – they were either worried themselves, discussing the topic due to curiosity, or even reporting it as part of their job. In fact, the crisis would have probably happened without their involvement. However, the social frenzy around FRB and the use of trending hashtags definitely escalated the problem, raising awareness and fear. The fact that the voices amplifying the crisis were influencers, journalists, and other reliable profiles made it trend higher, faster, and wider, proving once again that crisis management in any sector or industry can no longer be handled without dedicating resources and attention to social media platforms, which have the power and potential to turn any problem into a disaster.

Banking in the Age of Social Media

In mid-March, a large group of US banks intervened and injected money into FRB. US authorities are still actively working to avoid panic regarding the health of the banking system. Could FRB have avoided this crisis by tracking social discourse, catching the rumors and reports before they started trending, and reducing the damage by responding, debunking, and calming the spirits? Probably. Tracking social media during a sudden reputation or PR crisis is especially crucial, and can change the way a brand is seen by its clients and investors. Hopefully, in the future, we’ll see more banks recognizing the significance of social media, and taking steps to safeguard their reputation on this critical battlefield.

Worried About Trending Negatively? We’ve Got You Covered.

Protect your online reputation and receive direct alerts on any change in mentions or sentiment with Cyabra – contact us to set up a demo!